PHP – Python – Vue – RETS – AWS

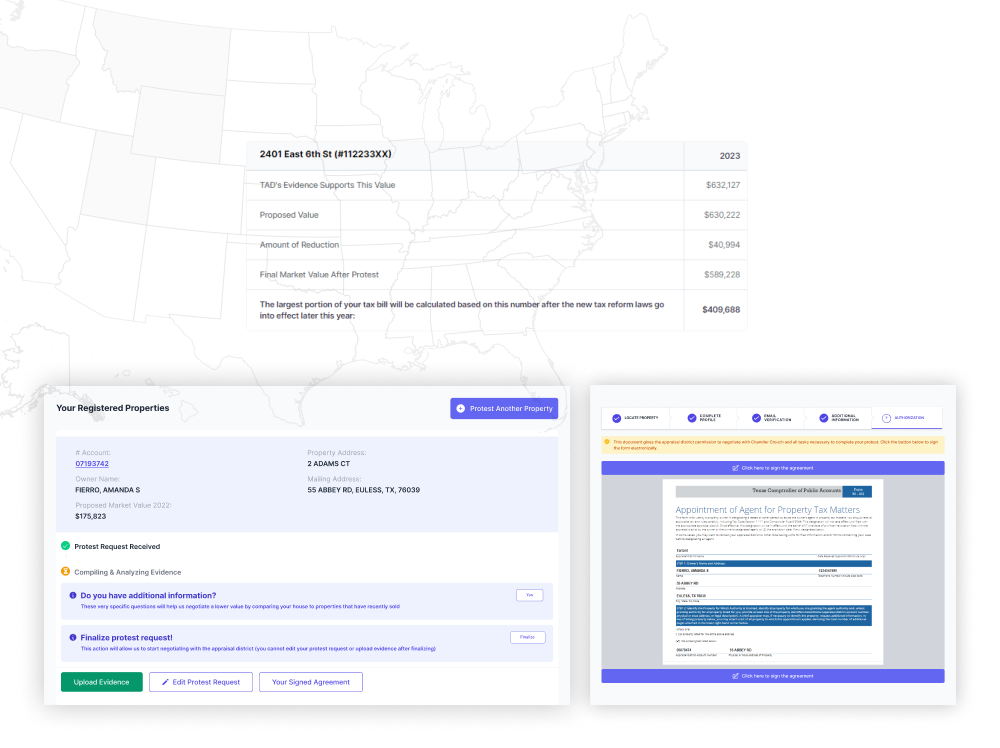

We have developed a customized property tax application tailored to meet the needs of property tax protesters in Tarrant County. Our client operates a company that offers services to residents of the county, enabling them to file property tax protests against the government. Our solution is designed to cater to property tax protesters across the state.

It’s important to note that only individuals who own land within the state are eligible to use the online property tax system and raise a protest. The system restricts access to a limited number of applicants who meet this criterion.

After successfully filing a protest through our online solution, the tax application keeps track of the applications using account numbers.

Creating the property tax application form posed a significant challenge as it involved handling a comprehensive questionnaire with a wealth of information. Our task was to seamlessly incorporate each question into an intricate protest form.

Our team diligently adhered to the guidelines and aimed to streamline the set of questions to ensure a user-friendly integration within the property web software solution.

One of the primary hurdles our team encountered was the organization of numerous spreadsheets and consolidating all the information into a single centralized location. The company had ambitious plans for rapid expansion, focusing on delivering efficient protest scheduling and approval services.

Lack of Transparency

Limited Recourse

Legal complexities

Public awareness

We are an established app development firm with expertise in property tax applications, and we have been a trusted technology partner for our client since the project’s beginning. Despite geographical distance and time zone differences, we successfully captured our client’s specific requirements for the property tax application.

💡 Our team worked meticulously to create a user-centric software solution that incorporates all the necessary business logic and monetization policies.

The ultimate result of the property tax protest process is the possibility of achieving a reduction in property taxes. Diligently following the well-defined steps provided on the platform significantly enhances the prospects of successfully contesting tax assessments. This, in turn, can lead to a tangible reduction in property tax obligations, offering considerable financial relief and ensuring a fairer tax assessment for the property. Beyond the potential financial savings, homeowners also gain a sense of assurance, knowing that proactive measures have been taken to address property tax concerns and secure a more equitable tax burden.